Usury and the Usage of Money

In these “modern times” interest is portrayed as a necessary part of the economic activity. However, is this really the case? In this article the answer to this question will be explored, and it will be shown that economic activity can and has been known to function very well without the presence of interest.

Published on May 27, 2021

During the last couple of thousand years of human history, attitude towards usury has been quite clear – it has been condemned and banned in many societies and civilizations as an unlawful practice, which harms the society and natural exchange flow of goods and services between the members of society. In the New Testament (around 2000 years old) we encounter the frequently cited statement (Matthew 6.24) No man can serve two masters: for either he will hate the one, and love the other; or else, he will hold to the one, and despise the other. Ye can not serve God and mammon.

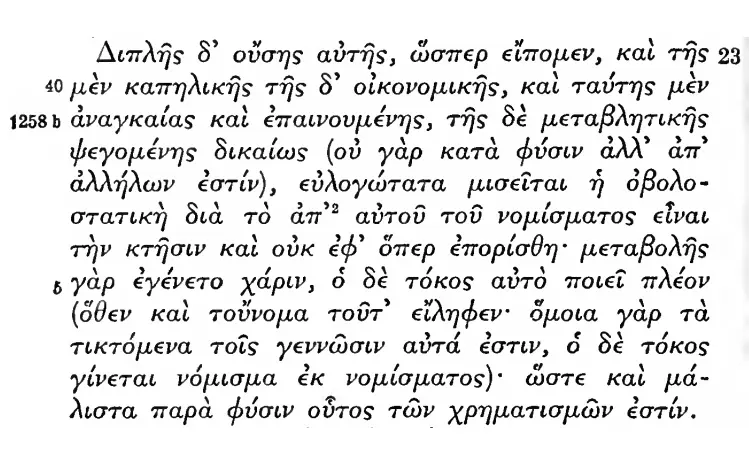

In ancient Greece, Aristotle condemned usury in no uncertain terms in his book Politeia, calling it, the birth of money from money, the most unnatural manner of obtaining wealth.1 The word used for interest was τόκος, τοκάριον, from τοκάω (to be near delivery), i.e., “τόκος = offspring”, thus metaphorically seeing interest as money born from money, “τοκάριον = small interest”.

In the Old Testament, Leviticus 25:(35,36,37) forbids usury upon “thy brother”. Deuteronomy 23: (19,20) clarifies again that “you should not lend upon usury of anything to thy brother” (fellow Jews), however, “unto a stranger thou mayest lend upon usury” (goyim).2

In The Divine Comedy, Dante Alighieri placed the usurers in the inner ring of the seventh circle of hell (circle reserved for violence), with blasphemers and sodomites. Blasphemers for violence against god, sodomites for violence against nature, usurers for violence against art (that is, human labor and activity).

In the Catholic Encyclopedia of 1907, a whole article is dedicated to the topic of usury. A plebiscitum, lex Ganucia, 412 a.u.c. (Ab urbe condita - since the founding of the city, or Anno urbis conditae – year since the founding of the city) went so far as to forbid all interest whatever, but, at a later period, the Roman law allowed interest at 1 per cent monthly, or 12 per cent per annum.3

In the Council of Elvira, first council held in Spain early in the fourth century at Illiberis, 81 disciplinary canons were issued, dealing with marriage, baptism, idolatry, fasting, excommunication, the cemeteries, usury, vigils, frequentation of Mass, the relations of Christians with pagans, Jews, heretics, etc.4 Usury was explicitly forbidden for clergy.5

William Shakespeare, in The Merchant of Venice, circa 1600, presents Shylock, a Venetian Jewish money lender, as a vengeful carrier of greed, and other negative characteristics.

Only in recent times has controversy been introduced to the concept of lending out money with the purpose of obtaining a money profit. There have been regular attempts to start promulgating usury as “a good deed”. Banks have increased their influence during the last centuries progressively in a continued crescendo.

20th century has seen the normalization of usury and monetary systems based on it. In the Encyclopædia Britannica of 1911 the following text can be read: The man who does not in some shape or other lend his capital upon “usury” is, in the modern world, generally considered as lacking in his duty to himself or his family.6 Later, in the same article, the ambiguous moral attitude throughout history towards usury is acknowledged. The positive attitude, however, is attributed to common sense morality and economic progress of the human society. Another dictionary, the Webster, in an edition of about the same time, has a rather neutral to negative opinion. Usury: interest on money beyond the current rate of interest; practice of lending money at exorbitant interest.7 In the edition of 1909, usury8 is defined as the practice of taking interest, or as exorbitant illegal interest. On the opposite side, the investor is declared to have the moral and economic right to enjoy his capital.9

Thus we see that usury is at times understood as the action of lending money with high interest, at times in general the action of lending money with any interest.

The same can be observed in other European languages: Usura: el interés que se lleva por el dinero en el contrato; Usurero: lo que sirve para sacar de alguna cosa una gran ganancia ó utilidad excesiva.10 (usury: interest carried by money in a contract; usurer: that which is useful to extract great gain or excessive utility.)

There have been several moneylending families in Europe, which have executed strong influence on the societies, e.g. the Medicis, the Fuggers, the Welsers, the Rothschilds. For instance the Rothschild family, through their banking activity, has among other things significantly contributed to the wide acceptance of interest in banking.

The Rothschild moneylenders

The modern interest-based financial system was chiselled in Frankfurt-am-Main, Germany. Mayer Amschel Bauer (1743-1821), who later changed his name to Rothschild and placed a large red shield over his door in the Judengasse, was the founder of the banking family. He discovered that although interest-based loans to farmers and small businesses could be profitable, the real profits lay in making loans to governments.

In 1812, when Mayer Amschel died, he left one billion franks to his five sons. His second son, Salomon, was sent to Vienna, where he soon took over the banking monopoly formerly shared among five Jewish families: Arnstein, Eskeles, Geymüller, Stein and Sina. The third son, Nathan, founded the London branch and the youngest son, James, founded the French branch of the House of Rothschild in Paris. Thus strategically located, the five sons began their lucrative operations in government finance.

Today, their holdings are concentrated in the Five Arrows Fund of Curacao, and the Five Arrows Corp. of Toronto, Canada. The name is taken from the Rothschild sign of an eagle with five arrows clutched in its talons, signifying the five sons. The first precept of success in making government loans lies in “creating a demand”, that is, by taking part in the creation of financial panics, depressions, famines, wars and revolutions.

Frederic Morton has stated in the preface to the book The Rothschilds that:

The history of the House of Rothschild has been to an amazing degree the backstage history of Western Europe… Because of their success in making loans not to individuals but to nations, they reaped huge profits… Someone once said that the wealth of Rothschild consists of the bankruptcy of nations.

E.C. Knuth has claimed in The Empire of the City:

The fact that the House of Rothschild made its money in the great crashes of history and the great wars of history, the very periods when others lost their money, is beyond question.

German historian prof Wilhelm has stated that:

The Rothschilds introduced the rule of money into European politics. The Rothschilds were the servants of money who undertook the reconstruct the world as an image of money and its functions. Money and the employment of wealth have become the law of European life; we no longer have nations, but economic provinces.11

Presence of Interest in Contemporary Society

Interest may be defined as the compensation that a borrower of capital pays to a lender of capital for its use.12

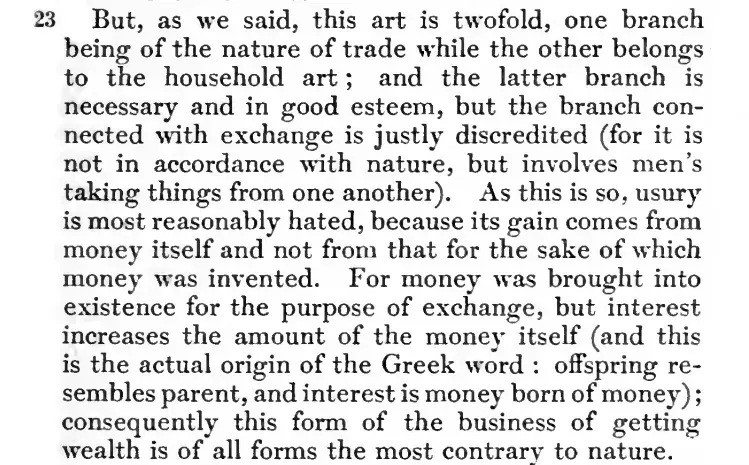

Interest has become so pervasive in modern society, that it is taught in high schools to children, for example, formulas to calculate it according to different rules are shown in regular high schools in the USA.

In 1930, Irving Fisher, a Professor of Economics at Yale University, published his treatise “The Theory of Interest”, a book of 601 pages.13 He has stated that the problem of interest is one of the most perplexing problems with which economic science has had to deal, and for two thousand years people have been trying to solve the riddle. Among the earliest explanations of the rate of interest was that it is a payment simply for money, and that consequently it depends upon the quantity of money on the market – people commonly speak of interest as the “price of money”.14 Fischer maintained that interest is needed to entice individuals to give up liquidity or sacrifice their present consumption, that is, to let someone else use their money for a period of time.15

In the process of present economic and social living, we all pay interest, even if we never take a loan from a local bank, or even if we manage to find a source in a friend or relative that will lend us money at zero interest. The reason is simple, and can be clearly seen if we examine a few examples. If you rent a house, the rent that you pay monthly will most likely include the cost in interest that the landlord has in capital investment in the building you are renting. If you bought your house from a builder, he probably built it using a loan on which he paid interest. This cost to the builder is most likely included in the sale price, otherwise, why would he go through the trouble? If you dine with your family and friends in a restaurant, in the price of the food and service put at your disposition is included the cost of food production and delivery, restaurant building and maintenance, plus some extra to pay for labor, etc. Somewhere in this long chain, if not everywhere, a loan was taken, thus causing an increase in the price that you are paying. Same applies if you always eat at home, cooking your own food. In general, we see that interest is always present, as a factor in the price paid for participating in the economic life of a group. It permeates every instance of it, making all prices higher than otherwise would be.

About money

Usury and inflation are phenomena related to money, thus, it is impossible to talk about usury without touching upon the nature of money. It seems to be a very simple concept, but behind this apparently simple idea details and intricacies are well hidden. As different economists have tried to explain what money is, they have discovered that it is not so simple. Many books have been written on the subject, and probably many more will be written as we humans unveil and understand better the energetic nature of money.

According to Ludwig Von Mises, money is a medium of exchange, a commodity whose economic function is to facilitate the interchange of goods and services, whether all present goods, or present and future goods, as in the case of credit. It is a transmitter of value through time and space.16 And then a whole book is dedicated to the examination of the nature, functions, kinds of money. We will use this as a working definition, which at least for the purpose of this article, seems to fit finely.

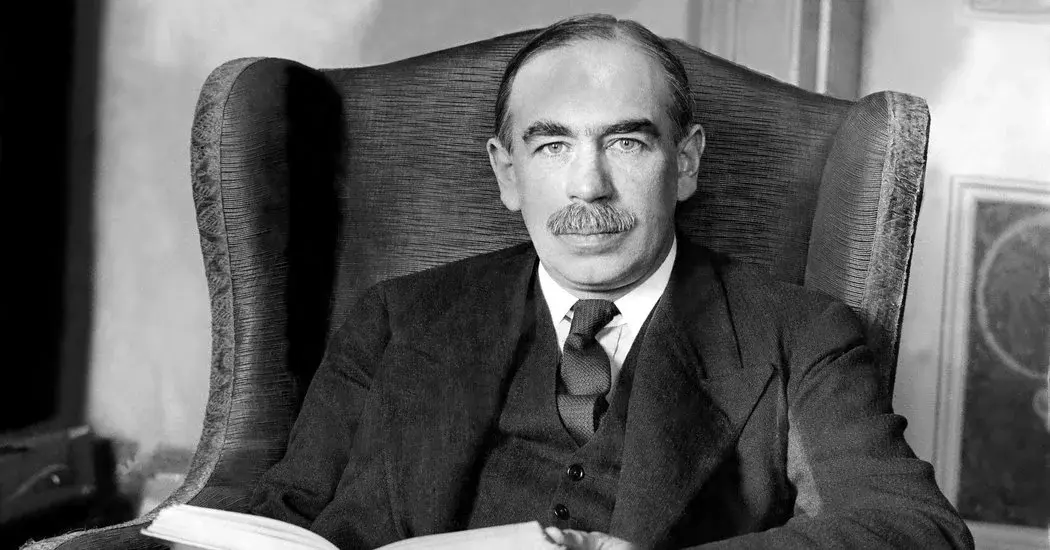

Many treatises have been written about money, e.g. John Maynard Keynes wrote a Treatise on Money in two volumes, Volume I: The Pure Theory of Money (375 pages) and Volume II: The Applied Theory of Money (431 pages); J. R. McCullock wrote “A Treatise on Metallic and Paper Money” in 1858; J. Shield Nicholson published a second edition “A Treatise on Money and Essays on Monetary Problems” in 1893, followed by a supplement in 1902. This list of authors suffices to show the “complexity” of the issue.

Inflation

Let us look now at the problem of inflation, using the common definition of inflation as the rise in the general level of prices. John Maynard Keynes and Milton Friedman, for example, had different approach and conception of some economic elements, how to influence and ultimately exert control on the economic life of the nation, including of course, the inflation phenomenon. According to Friedman, the appropriate aim of monetary policy is control of the price level (thus control of inflation).17 It has been disputed what should the centre-piece be of the monetary mechanism, the structure of interest rates or the supply of money? Does the first affect the second or the second determines the first? Or perhaps are both consequence of some third unknown, or not yet considered factors? Discussing the empirical observation of Irving Fisher that inflation is associated with low unemployment, and deflation with high unemployment, comparing it with Professor A. W. Phillips’ analysis, Milton Friedman makes reference to the different direction of causality assumed by both authors.18

Inflation has been studied as a function of demand, a function of the amount of circulating money, of the interest rate, etc. At any rate, all theoreticians of economics have understood that through the manipulation of money supply and flow, many economic parameters can be influenced and ultimately controlled. This of course demonstrates that the energetic character of money is widely accepted, very clear and undisputed.

Inflation as a tax

Inflation is an established way of hidden taxation, hidden since most people are unaware of its effects, taxation since it moves part of the wealth away from the taxed part of the population. John Maynard Keynes once wrote that By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.19

Alternative monetary policies not based on interest

In 1906 and 1911, Silvio Gesell, a German-Argentinian merchant and economist, had published a book on natural economic order in two parts in German. In 1916 it was published as one single volume under the title of Die Natürliche Wirtschaftsordnung in Berlin and in Spanish in 1936 in Argentina.

He had observed that money could be kept without cost, it didn’t go bad, as most of other goods do. Money could be held for unlimited time out of circulation. He wrote that in a commercial exchange, money is always needed, thus, this transaction could be largely controlled by the owners of money, explaining that the possessor of money can demand profit from the producers, because he can paralyze the exchange of wares by withholding his money. This possessor has the ability to control the economic activity within the society. Thus, to avoid this from occurring, money must be made to circulate. Gesell suggested that people should pay a fee for keeping money out of circulation longer than needed for the exchange of goods. He suggested a “rust” rate of 0,001 of the note’s face value per week. The collected fees would be put back in circulation.

In his book he introduced the ideas of free money, money without interest. In his words, from the English translation:

Only money that goes out of date like a newspaper, rots like potatoes, rusts like iron, evaporates like ether, is capable of standing the test as an instrument for the exchange of potatoes, newspapers, iron and ether.20

However, as shown by Margrit Kennedy, the manner in which, and how much interest affects the individual is not the same for all participants of society.21 A statistical analysis of the German population lead her to this conclusion. In a few words, if you consider the inflow (income generated by lending) and outflow of money to or from the personal/family capital caused by interest, for some the inflow is nonexistent, for others, for whom inflow is positive, it could be equal to, or surpass the outflow, in some cases considerably surpass. Simultaneously, there is outflow for every single member of the society, as shown earlier. Thus, to put in mathematical terms, if we consider the outflow as negative and the inflow as positive, the final balance resulting from the interest flow could be negative, zero, or positive.

Non-Western Banking Systems. Islamic Banking.22

Not all banking systems use interest. The following is a short reference to the position of interest in the Islamic Banking System.

In Islamic banking, interest (Riba) is forbidden. “Riba” is an Arabic word, and it means: Excess, Increase or Addition. In Quran and Hadith it is used for “usury”, or “interest”. The following kinds of Riba are considered:

- Riba An Nasiyah

- It is also called Riba Al Jahiliya, and it refers to the addition of the premium, which is paid to the lender, in return for his waiting as a condition for the loan. It is technically the same as interest, and this is the real and primary form of Riba.

- Riba Al Fadl

- It is also called known as Riba Al Bai, and is defined as excess compensation, without any consideration, resulting from a sale of goods.

- Laws Regarding Riba Fadl

- Any difference in value or quality should be ignored and the commodities should be exchanged in equal weight and volume.

Instead of direct exchange of commodities of the same kind, a person should sell his commodity against cash at the market value, and buy someone else’s commodity in exchange of cash at the market value.

Islam prohibits Riba in Islamic banking, due to the following:

Riba inculcates miserliness, selfishness, callousness, indifference, inhumanity, greed, and worship of wealth. It destroys the spirit of sympathy, mutual help and cooperation, and thus affects the feelings of brotherhood and unity among the community.

Riba is prohibited because it causes many economic evils, for example:

It leads to hoarding of money, adversely effecting its circulation among larger sections of society.

It also causes establishment of monopolies, cartels, and concentration of wealth in few hands. And so, the gulf between the rich and the poor widens.

Similarly, but even more implemented in practice, there have been many examples of local currencies, which have been offered as alternative monetary tools to central banking systems based on interest. Those currencies have been mostly inspired by policies, which are not based on interest and urge users to keep money in constant flow and use.

Some Regional Financial Experiments

In the words of the financial expert Catherine Austin Fitts, currency simplifies and facilitates the process of buying and selling things, being one of the greatest time savers that mankind ever invented. In an article, she tells that

At the end of the great depression in the 1930’s, there were over 3,000 community currency systems in operation in America. While most of them then disappeared, there is a new interest in community currency, particularly for the prospect that it may help people save time and circulate resources back in their local areas.23

Around the year 1955, the German-British Ernst Friedrich Schumacher visited Burma, and while there developed the principles of what he called “Buddhist Economics”, based on the idea that “production from local resources for local needs is the most rational way of economic life.” In a center and website dedicated to his lifework, over fifty different alternative currency projects around the globe are listed.24

In California, during the financial crisis of 2007-2008, were formed 19 city currencies. In the UK alone, Totnes, Lewes, Brixton and Stroud – all Transition Towns – have their own local currencies. They were significant enough, so much that the Bank of England deemed necessary to issue a warning bulletin.25 In 2019 there were over 75 active local currencies in the US – in almost every state. There are also five interstate US currencies – not including the Disneyland dollar!26

In the following, a number of local currencies will be mentioned with an aim to introduce the subject and the advantages of independent currency systems.

TEM

During the debt crisis that took over the Europe around 2012, in many countries local currencies flourished. Greece, that had been hit with severe austerity measures for already a few years, was one of these countries. In Volos, a new local currency was created, of more than a dozen in the country, called TEM.27 Its network was run from a seamstress shop. Members of the network paid for products and services partly with euros, partly with TEMs. The transactions were recorded on paper and electronically, without physical currency. To keep the currency in circulation and avoid hoarding, no one was allowed to keep more than 1200 euros. People were upbeat, the local economy flourished, the local government agreed to accept a part of the fees in TEMs.28

Brixton Pound

In September of 2009, in Brixton, UK, a local currency was launched, the Brixton pound, which was a paper note. They had noticed that 93% of money spent in supermarket chains immediately left the area, going in different directions outside Brixton, to general supply chain cost, shareholders, etc. According to some studies, 70 to 80 percent of the money spent in local shops stayed in the area. Ten thousand Brixton pounds were put in circulation. After a year, they introduced a mobile solution, the customer via a text message sent a text from his phone to the merchant account, confirmation was received very shortly after. The Brixton pound circulated 2-3 times locally before been exchanged into pounds sterling. In September of 2011 a second version of the banknote was issued.29

Chiemgauer

In 2003 the Chiemgauer was created as a local currency in Bavaria, Germany.30 It was started as a high school project. The creator was inspired by Rudolf Steiner and Silvio Gesell. The exchange rate is 1 to 1 with the euro. To prevent hoarding and promote circulation, a “scrip” of 2% must be paid every three months on the bank notes’ value. The reasoning is that to avoid paying the scrip, the note bearers try to spend it as soon as possible. By July of 2010, more than 600 local businesses were accepting the Chiemgauer.31

Ithaca Hour

In 1991, in Ithaca, New York, the Ithaca Hours were launched by Paul Glover, as an alternative local currency. They were successful enough to attract the attention of the Chinese Central Bank, PBS (Public Broadcasting System, US), Japan’s Ministry of International Trade & Industry’s (MITI) Service Division, Toshiriharyu Kato wrote a paper endorsing them. Originally one Ithaca Hour was equivalent to ten USD, somewhat the average local hourly wage at the time. From the beginning, about 90 people agreed to accept Ithaca Hours as payment means. On October 19, 1991, Paul Glover bought a samoza at the Farmer’s Market with Half Ithaca Hour #751 from from Catherine Martinez‒ the first use of an Ithaca Hour. Neither one knew what a Half Hour was worth, since the $10/Hour rate was then merely suggested. Several more Market vendors enrolled.32 In the interview with James Corbett, Paul Glover said that they avoided inflation without demurrage (rot fee) by setting a maximum amount of Ithaca Hours money in circulation. Making sure that money stays circulating is the best demurrage, he said.

Tenino

During the plandemic Covid-19, in the town of Tenino, state of Washington, with a population of about 1900 people, many local businesses were destroyed. Residents could barely afford groceries, long lines were formed at the food banks. Then the mayor decided that instead of asking for grants and help from the federal government, they could print their own money. They used a old newspaper printer from the late 1800s from a local museum, that had already been used during the Great Depression to print sets of wooden dollars. The town decided to use that exact same 1890 newspaper printer. Residents below the poverty line could apply to receive money from the $10k fund that Tenino has set aside. Once approved, they could pick up wooden notes worth $25 each. The city capped the amount each resident can accrue at 12 wooden notes — or $300 — per month. The restrictions were: Can’t buy cigarettes, lottery tickets, or alcohol. The currency was designed for the essentials, including food, gas, and daycare. Almost every business in town accepted the wooden notes, and twice a month, they could turn the notes into cash.33

WIR

In 1934, in Switzerland, the WIR monetary unit without interest was created. The WIR Bank ceased to be a non-profit entity when it expanded. Beyond the founders, Enz and Zimmerman, they were inspired by Silvio Gesell’s ideas about non-interest in money, but this position was abandoned in 1952, when interest in WIR credits began to be collected. During the period from '38 to '48, demurrage was applied, using a validation stamp. According to recent statistics, the WIR has more than 50,000 members (17% of the total number of Swiss businesses) with annual revenues of 1.5 thousand million Euros. Exchanges in WIR represents between 1 and 2% of The Swiss GDP.34

BerkShares

BerkShares are a local currency for the Berkshire region of Massachusetts.35 Federal currency is exchanged for BerkShares at nine branch offices of three local banks and spent at more than 400 locally owned participating businesses. The circulation of BerkShares encourages money to remain within the region, building a greater affinity between the local business community and its citizens. Consumers can exchange their US dollars for BerkShares at any of five banks in the area, at a 5 percent savings; in other words, $100 will buy you $105 BerkShares.

The BerkShares may then be spent at the approximately 350 locally owned participating businesses, with buying power identical to that of regular currency. On a recent afternoon at Bizalion’s Fine Foods in Great Barrington, Massachusetts, a hummus platter and cup of coffee that cost slightly over $10 was purchased with 10 BerkShares.36

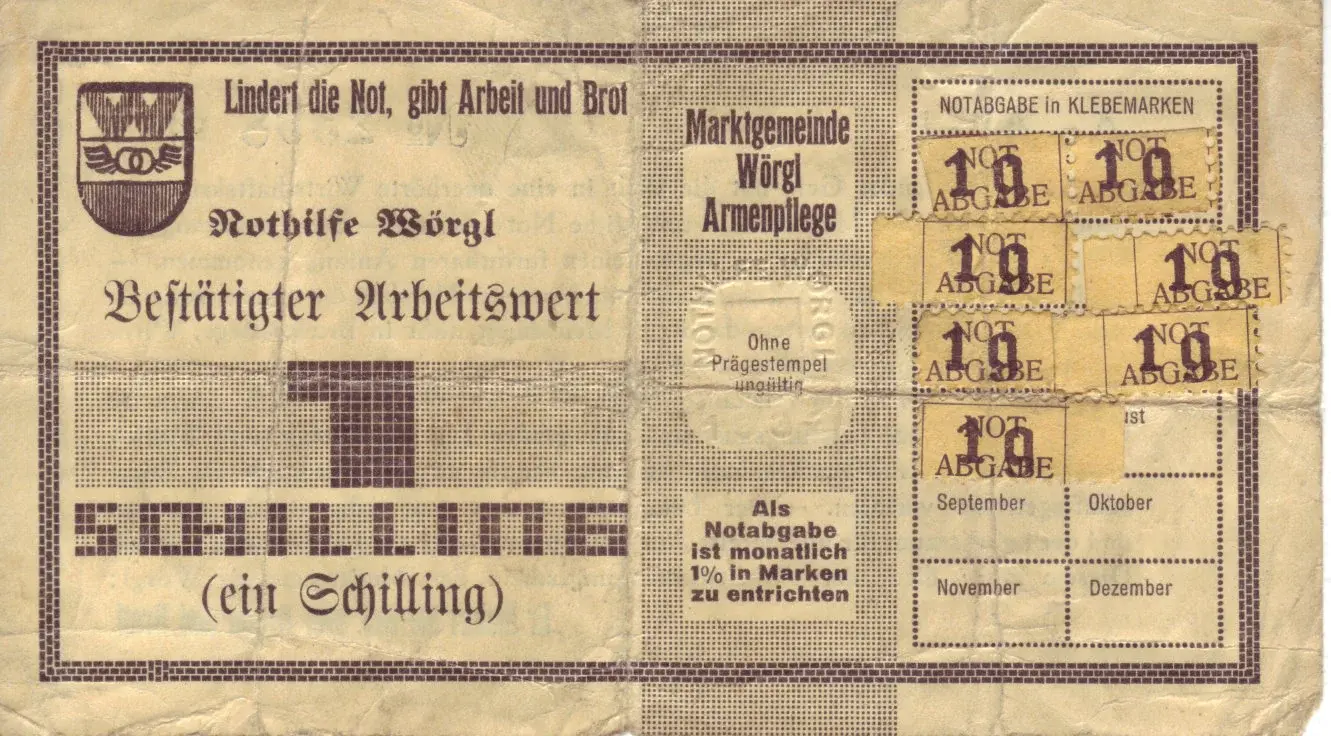

Wörgl

Started on July 31, 1932, in the Austrian town of Wörgl, with the issuing of local currency commonly known as Stamp Scrip, or Freigeld. This was an application of the monetary theories of the economist Silvio Gesell by the town’s then-mayor, Michael Unterguggenberger. The experiment resulted in a growth in employment and meant that local government projects such as new houses, a reservoir, a ski jump and a bridge could all be completed, seeming to defy the depression in the rest of the country. Inflation and deflation are also reputed to have been non-existent for the duration of the experiment. In January 1933, the project was copied in the neighbouring city of Kitzbühel. In June 1933 major Unterguggenberger addressed a meeting with representatives from 170 different Austrian towns and villages. Two hundred Austrian townships were interested in the idea. At this point the central bank decided to assert its monopoly rights by banning scrip money. Despite attracting great interest at the time, including from French Premier Edouard Daladier and the economist Irving Fisher, the “experiment” was terminated by Austria’s central bank Oesterreichische Nationalbank on September 1, 1933.37

In the opinion of Bernard A. Lietaer, the local currency of Wörgl demonstrates that the economy can do well without more debt if money keeps circulating. Negative interest rates can make that happen. Stamps on money like in Wörgl make negative interest rates possible as you can avoid paying for stamps by lending out money. For instance, lending out money at a negative interest rate of 2% per year would be more attractive than paying for the stamps. Negative interest rates might have prevented the depression or ended it once it had started.

There have been and are many other local currencies, in different countries and times, that have not been reviewed in this article, however, it does not mean that they are less important.

The influence of Silvio Gesell can be perceived in so many of these “alternative currencies”. Notably, also economist Irving Fisher was interested in the works of Gesell38. In general, it appears that the rejection of usury (interest) as a way of acquiring wealth, expressed by Silvio Gesell in his book “The Natural Economic Order” have resonated with many, and been influential. This can be seen not only in the declarations made by those that have helped develop in practice alternative local currencies in the XX and beginnings of XXI centuries, but also in several economists.

Other examples that could be indicated are Interest and Inflation Free Money by Margrit Kennedy and The Modern Idolatry, being an Analysis of Usury & The Pathology of Debt by Jeffrey Mark.

In his book, Jeffrey Mark makes a few remarkable statements, for example: “Psychologically, usury is based on the desire to get something for nothing.”39 and later on emphasizes the idea of keeping the money flowing, not static:

To bring about a situation in which money will come to be regarded purely as a medium of exchange, the financial mechanism must be altered so as to prevent people from saving and thereby creating interest-bearing debt through the investment of these savings. They must be prevented from saving and creating debt, and forced to spend and consume.40

The intention of this article is not only to discuss the nature and function of money and interest from an academic point of view, but also reveal some of the esoteric side of money.

Esoteric Considerations About Money

In the esoteric symbolism, the “sword” means the energies of the first department; the “pen”, those of the second department; “money”, those of the third department.41

Esoterically, money is regarded to be part of the motion or energy aspect of existence. According to hylozoics, the teaching of Pythagoras, which has been brought to us by the Swedish hylozoik philosopher Henry T. Laurency:

Energy in the scientific sense is matter in motion. All higher kinds of matter (atomic kinds, molecular kinds) are energy in relation to all lower kinds.42 All forces of nature are matter. There are more than 2400 different kinds of forces of nature within the solar system. Every molecular kind contains 49 different layers of matter, which can all act as energy.43

In the esoteric symbolism, “money” means the energies of the third department in the physical world.44 The organization of manifestation is based on the division into seven departments. The purpose of departments is, as is that of many other things, differentiation, multiplicity in unity, the expedient distribution of work, the education of specialists. In them, seven main types are educated for various functions in the process of manifestation.45 These seven departments are also related to the main centres (chakras) in the human individual, three below and four above the diaphragm.

The first three departments are the main ones corresponding to the three aspects: will, consciousness, matter; the first three processes of manifestation; and the three collective beings: guardians of law (supervisors of balance), guides of evolution, and formers of matter.

Money is the effect of physical etheric energies (49:3, 49:4) pouring into the physical visible world (which consists of three states of matter – physical solid or 49:7, physical liquid or 49:8, and physical gaseous or 49:5). Here, 49:3 is the second etheric molecular layer, 49:4 is the first etheric layer, if we count from below, from the densest layers, yet both still belong in the physical cosmic world 49.

Another consideration is that time is related to the motion aspect of existence, of the three equivalent aspects: matter, consciousness and will or motion.

Fear and other emotional disturbances, that is, disturbances in the lower regions of the emotional world (world 48), send energy currents that counteract the correct work of money by destabilizing the correct intended purpose of this concretized etheric force. It can be observed that these disturbances, ultimately based on the paralyzing power of fear, are frequently artificially planned and created with sinister purpose.46

If money doubles or triples, or merely increases its amount after so many years due to interest, by doing so, it indicates that the money holder is acting as a vampire that draws to itself energy whose real purpose is to serve as motor for the economic activity of society, without having participated in it. Energy (that is, higher kind matter) comes from “above”, it can not generate more of itself in the same molecular world. We are back to Aristotle’s reasoning.

Wrong Use of Money

We shall be held responsible for the manner in which we use our money. It is not our property, which you will see when you study your incarnations. Wealth is good reaping but also a test as to how you look on wealth and how you administer it.47

Usury, the excess money created of just owning and lending monetary assets, has contributed to progressive concentration of wealth into the hands of very few. In our present civilization, this financial elite, e.g. the owners of the biggest commercial banks, are exercising excessive influence over the rest of mankind. This banking elite has enriched themselves fabulously at the cost of billions of people, have bankrolled wars and revolutions (e.g. please see The Russian Revolutions of 1917, part 1 ), brought immense suffering on whole nations, and made huge profits on it.

Several observers of the world affairs have noted such effect of the actions of those, who are governing huge amounts of financial assets. For instance historian Carroll Quigley has defined the aim of financial elites in the following:

The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.48

3rd President of the United States (1801–1809), Thomas Jefferson, has stated that:

I sincerely believe, with you, that banking establishments are more dangerous than standing armies.49

32nd President of the United States (1933–1945), Franklin Delano Roosevelt, has admitted that:

The real truth of the matter is, as you and I know, that a financial element in the large centers has owned the government ever since the days of Andrew Jackson.50

Large amounts of money have been and continue to be diverted to propagate and sow wrong perspectives, twisted life and world views in the population, especially focused in the new generations51, aimed at the debilitation and destruction of society from within, especially societies composed by representatives of European cultures and traditions. The attacks on the stability of human societies are well funded with very large sums of money, directed by groups that act under the disguise of charities, benefactory associations and NGOs. A widely known front-man of these groups is William Henry Gates III (Bill Gates), who is frequently promoted by the mainstream media as a planet savior, supreme expert in medicine and vaccines, computer genius, philanthropist, etc.52 Curiously, they forget to how, despite forcefully promoting UN 2030 Agenda (You will not own nothing, you will be happy53), Bill Gates has become the largest farmland owner in the US.54 Culling of the planet human population55 seems to be an obsessing thought for B. Gates and many other ultra-rich people, who dedicate significant amount of money to these projects.56 Also, his investments have been described as follows:

His investment history suggests that the climate crisis, for Gates and his cronies, is no more than an alibi for intrusive social control, ‘Great Reset’-scale surveillance, and massive science fiction geoengineering boondoggles, including his demented and terrifying vanity projects to spray the stratosphere with calcium chloride or seawater to slow warming, to deploy giant balloons to saturate our atmosphere with reflective particles to blot out the sun, or his perilous gambit of releasing millions of genetically modified mosquitoes in South Florida. When we place these nightmare schemes in context alongside the battery of experimental vaccines he forces on 161 million African children annually, it’s pretty clear that Gates regards us all as his lab rats.57

Other so called tech giants also seem to have had access to unlimited money supply at the beginning of their careers58. George Soros is another ultra-wealthy individual who specializes in diverting enormous amounts of money to, among other abominable projects, LGBTQ and feminist agendas, NGOs and other organizations that under the “open society” appellative contribute to destroying the healthy structural solidity of society.

Money in enough quantities seems to be always available to promote and finance destructive indoctrination of children, gender confusing theories, transsexualism imposed on children and the careers of functionaries and politicians that favor such agendas. For instance, important revelations came to light during the conference given by Richard Day in 1969 in Philadelphia. Richard Day was the director of “Planned Parenthood”, which was founded by Rockefeller. Many of the destructive social engineering projects brought to life throughout the years were then announced.59

Financial analyst Catherine A. Fitts, a former Assistant Secretary of Housing during President George H.W. Bush, has discussed extensively about the financial powers and their real goals – how they aim at depopulation, their intended enslavement of humanity, etc.60 She has been very vocal about the misuse of money: black budget to fund illegal operations, Covid-19 pandemia as a planned and profitable event, pedophilia among the powerful, etc.

Ronald Bernard, a dutch banker, has also made astonishing statements, accusing the financial elites of pedophilia, child sacrifice, and other atrocities. In a five part interview, he tells the story on how to reach certain level in the financial world – for instance the applicant must agree to participate in these rituals.61

The idea that Silvio Gesell had about making static money deteriorate with time can be twisted and used for nefarious purpose,62 when its aim is to have control of the population and not the preservation of the money flow. For example, China’s digital currency can be programmed to have an expiration date. Electronic recording of transactions that worked positively in the case of the TEMs and the Brixton pounds can be used for an increased surveillance, tracking and control of the population using this type of currency.63 Interestingly, China found that SWIFT (Society for Worldwide Interbank Financial Telecommunication), the global system for financial transactions across borders, was ready to collaborate with them in this venture.64 This despite the fact that SWIFT has been known to be under the control of the US in some instances, and that the Chinese digital currency can be a substantial threat to the US dollar. Once again, China is at the forefront of “innovations” - in 2021 it is the first country ready to launch a national digital currency.

Multiple and horrendous can be, have been, and are in modern times, the misuses of money. The above examples represent only a small collection of them.

The key to humanity’s trouble (focusing, as it has, in the economic troubles of the past two hundred years, and in the theological impasse of the orthodox churches) has been to take and not to give, to accept and not to share, to grasp and not to distribute.65

Conclusion

It is to be expected that the more in consonance a currency system is with the energetic nature of money, the better it will be. Etheric currents are in constant flow. The smaller the amount of “immobility” added to its concretized form in the process of solidification into 49:5-7, the better the downscaled version will function and be. This better downscaling should also include zero interest (absence of τόκος, no offspring), and some kind of measure that would keep the money flowing as much as possible.

It is interesting to observe (directly in the linked videos) the sense of harmony and community described by the users of Ithaca and Volos local currencies. This is an indirect confirmation that those local currencies are a better downscaling of the source energies than regular money.

The demurrage penalty may not be the best solution, since taken to the extreme it can be a very effective repression and control tool. The planned expiration date of digital currency is after all a demurrage of 100%. Implementations of currencies must be carefully examined and studied, behind a seemingly good idea an effective poison may be hidden.

The best plans can come to nothing if brought to life in the wrong circumstances by the wrong people. Perhaps the solution will come slowly, with different solutions for different countries or even small regions.

Αριστοτελουσ Πολιτικων, LOEB Classical Library, Volume 264, page 50. Harvard University Press, MCMLIX ↩︎

The Holy Bible, King James Version. Barnes & Noble, New York, 2012. ↩︎

The Catholic Encyclopedia, New York, 1907, Volume XV, page 235. ↩︎

Encyclopædia Britannica, 1911 Edition, Volume 27, page 812. ↩︎

Adair & Petty, The New Supreme Webster Dictionary, page 738. New York 1919. ↩︎

Webster’s Condensed Dictionary, page 646, Chicago, The Reilly and Britton Co., 1909. ↩︎

The Theory of Interest, as Determined by Impatience to Spend Income and Opportunity to Invest it, page 51, by Irving Fisher, Professor of Economics, Yale University. New York, The Macmillan Company, 1930. ↩︎

Diccionario de la Lengua Castellana por la Academia Española, página 876. París, 1826. ↩︎

Professor Wilhelm in the New York Times on July 8, 1937 ↩︎

Stephen G. Kellison, The Theory of Interest, Second Edition, page 1 . Georgia Sate University, 2000. ↩︎

The Theory of Interest, as Determined by Impatience to Spend Income and Opportunity to Invest it, by Irving Fisher, Professor of Economics, Yale University. New York, The Macmillan Company, 1930. ↩︎

Irving Fisher, Professor of Political Economy, Yale University. Elementary Principles of Economics, pages 327-329 New York, The Macmillan Company, 1911. ↩︎

Stanley L. Bruce, Campbell R. McConnell, Sean M. Flynn. Essentials of Economy. Pages 375-376 ↩︎

Ludwig Von Mises, The Theory of Money and Credit, Chapter 1. Vienna, 1924. Translation to English, 1981. ↩︎

Money, Inflation and the Constitutional Position of Central Banks, page 27, by Milton Friedman and Charles A. E. Goodhart. The Institute of Economic Affairs, London, Great Britain, 2003. ↩︎

Money, Inflation and the Constitutional Position of Central Banks, Chapter 2, pages 41-42, by Milton Friedman and Charles A. E. Goodhart. The Institute of Economic Affairs, London, Great Britain, 2003. ↩︎

The Economic Consequences of the Peace, page 220; by John Maynard Keynes, Macmillan and CO., London, 1920. ↩︎

Silvio Gesell, The Natural Economic Order, page 269. Revised English Edition, 1958. ↩︎

Margrit Kennedy, Interest and Inflation Free Money, page 25. New Revised and Expanded Edition. Okemos, Michigan, U.S.A, 1995. ↩︎

David Boyle. The Money Changers: Currency Reform from Aristotle to E-cash, pg 236. Bernard Lietaer, The Future Of Money. (2002). Cornerstone / Cornerstone Ras. ↩︎

Jeffrey Mark The Modern Idolatry, being an Analysis of Usury & The Pathology of Debt, pg 3. (London, 193) ↩︎

Ibidem, Chapter XXIII, page 179. ↩︎

Henry T. Laurency The Way of Man, 18.27.8: HTL Website ↩︎

Henry T. Laurency The Knowledge of Reality, 1.26.1: HTL Website ↩︎

Ibidem, 1.26.4: HTL Website ↩︎

Henry T. Laurency The Way of Man, 18.27.8: HTL Website http://www.laurency.com/ ↩︎

Henry T. Laurency The Philosopher’s Stone, 2.50.1: HTL Website ↩︎

Henry T. Laurency, The Way of Man, 11.12.15: HTL Website ↩︎

C. Quigley Tragedy and Hope: A History of the World in Our Time (1966), p 242 ↩︎

Thomas Jefferson in a letter written to John Taylor on May 28, 1816 ↩︎

Franklin Delano Roosevelt in a letter to Colonel Edward M. House dated November 21, 1933, as quoted in F.D.R.: His Personal Letters, 1928-1945. ↩︎

Woke Story Time with Priscilla Giddings; Rep. Heather Scott: Idaho universities are training teachers how to indoctrinate school kids; Catholic university LGTBI grad celebration honors pretty much everyone but heterosexuals (April 2021) ↩︎

Eric Karlstrom Microsoft Patents New Cryptocurrency System Using Body Activity Data (September 2019), Eric Karlstrom WO2020060606 – CRYPTOCURRENCY SYSTEM USING BODY ACTIVITY DATA (March 2020) ↩︎

C.A. Fitts ; C.A. Fitts interview with Greg Hunter “We are Dealing with a Spiritual War” ↩︎

Ronald Bernard interviews part 1; part 2 ; part 3 ; part 4 ; also ↩︎

Ibidem ↩︎

Alice A. Bailey Telepathy and the Etheric Vehicle, page 45. Lucis Publishing Company, 11th Printing, 1995. ↩︎